The Price Of Live Music? Inside Ticketmaster's Monopoly And The Fight For Grassroots Survival

- Riley Edmett

- Dec 4, 2025

- 5 min read

Updated: Dec 23, 2025

In 2024, Ticketmaster UK reported gross profits of just over £142 million. That same year, the Music Venue Trust reported that over 200 grassroots music venues were on the brink of permanent closure.

As arena and stadium shows continue to dominate the live music industry, the divide between stadium and grassroots is as big as it's ever been.

The UK live music industry contributed a record £8 billion to the economy in 2024, per a report from UK Music. Tours from major artists including Take That, Taylor Swift and Bruce Springsteen helped drive the figures, making it a very strong year financially for the industry. A major contributor to this was ticket sales and distribution giant Ticketmaster, often the sole point of purchasing tickets for these shows.

Ticketmaster's UK subsidiary, Ticketmaster UK, has seen steady growth of gross profits over the last five years, as outlined in the graph below. 2024 saw a gross profit increase of 115% from the previous year, with figures of £142,388,000.

The increased profits reflect what Jon Collins, chief executive of LIVE, describes as a "massive appetite" for large scale shows and tours, set against the backdrop of worldwide inflation.

Whilst the growth is good for the UK economy, this has also been subject to controversy, with many struggling with the rising ticket costs. Ticketmaster has been subject to scrutiny and complaints from a variety of public figures stemming from this, with recent government backing to cap resale prices, and ticket prices being impacted by hidden fees and "dynamic pricing" (a practice where ticket prices fluctuate in real-time based on demand).

However, Ticketmaster's monopoly on the live music industry is evident, with a conducted survey showing 68% of respondents (17 out of 25) using the service as their primary place of buying tickets. And when asked what the most they'd spend on a ticket would be, responses ranged from £20 to £300, highlighting the sheer difference in live music pricing and what general audiences are willing to part with to experience it.

"It's a machine that feeds itself," Adam O'Sullivan, owner at The Six Six Bar in Cambridge, described when I asked about Ticketmaster's pricing system. "Once prices go up, they never come back down.

"But none of that's on grassroots venues."

The Six Six Bar is one of many grassroots music venues (GMVs) in the UK, a sector that currently comprises over roughly 800 venues across England, Scotland, Wales and Northern Ireland. Adam has owned the Six Six since it officially opened in 2022, and day-to-day duties include booking shows, dealing with money, and fixing things that need it. "Basically, if it happens here, I'm involved in it one way or another."

Whilst Ticketmaster UK has seen continued growth, seeing a return to pre-pandemic figures, grassroots venues are struggling to stay afloat. Rising costs, dwindling interest, and a lack of financial support are main contributors, with the Music Venue Trust stating in their 2024 annual report that 44.2% of venue closures were due to financial issues.

"Grassroots venues like ours live permanently on a knife edge," Adam explains.

In a stark contrast to arena tour tickets getting more expensive, Adam describes that it's not just as simple as increasing grassroots ticket prices: "Everything costs more every single year - rent, rates, insurance - but we can't just slap £50 on a ticket to cover it. The minute you push prices too far, people stop coming."

Over the last few weeks, prices for events at the Six Six ranged from £5 to £13, showing the range in what can be offered at a grassroots venue. Adam explains the process behind setting ticket prices for a grassroots event at a venue like the Six Six - "[It's] what the bands need to make it worth their while, what it costs us to actually open the doors, and what people in Cambridge will realistically pay." The Six Six, just like any other GMV, needs to remain affordable for everyone, Adam explains, or risk "defeating the point" of grassroots music.

But, as Adam describes, without grassroots venues or bands, there would be no arena bands. "We're the ones nurturing the bands that eventually fill those stadiums, but we don’t get any of the financial protection [they] get.

"At the top you’ve got Ticketmaster making hundreds of millions because they control stadiums, arenas, the ticketing system and basically everything. And then at the bottom, you’ve got venues like us fighting every month to survive. It's an industry split in two."

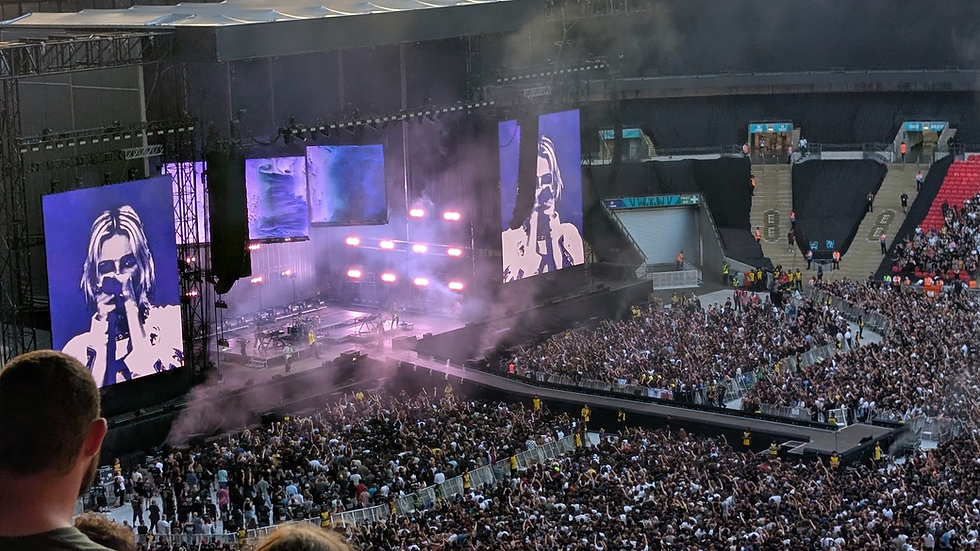

Looking at the data, it's fair to predict that this year will see another increase for Ticketmaster, with a year that included tours from bands such as Guns 'n' Roses, Coldplay, and record breaking shows from Linkin Park and Oasis at Wembley Stadium. Tickets for the latter shows averaged at £144 for general standing, over 11 times the price of a £13 ticket for a tribute band show at the Six Six Bar.

It's easy to take into account the added costs, staff, stock, that a stadium will need, as well as the star power major acts can bring, but there is still a clear disparity between the two sectors of the UK music industry.

"There’s plenty of blame to go around," Adam considers. "Promoters, ticketing giants, management, exclusivity deals, dynamic pricing all that stuff. But we're not the ones rinsing people for £200 seats".

We end the interview with a reflection on what the future of UK grassroots might look like, up against the backdrop of Ticketmaster. "I want bands to have places to grow. I want fans to still have affordable places to discover something real. If we get the support we need, the grassroots sector could absolutely explode in the best possible way.

"The talent is there. The passion is there. It just needs the system to catch up."

Whilst the future of grassroots is uncertain, there is one thing for sure: the "appetite" for live music continues to increase, with major tours from My Chemical Romance, Foo Fighters and Bon Jovi (among others) set to hit the UK next year.

Ticketmaster continues to cement itself as a giant in the industry, and only time will tell where grassroots sits compared to this.

Data source: Ticketmaster UK LTD, Companies House filings

Comments